Gateways

The gateways view presents the scaffolds that configure the third-party automatic charge posting mechanisms that are built into the rXg.

The rXg has a fully integrated double-entry accounting system that keeps an accounting journal for each Account. The rXg may be configured to automatically post credits to the journals associated with each Account through a number of manual and automated mechanisms. The operator may choose to manually issue credit based on manual payment processing. Alternatively, the operator may sell or issue coupons that are automatically redeemed for credits in the captive portal.

The mechanism that achieves the most benefit when deployed in conjunction with zero operator intervention is fully automatic payment processing. To accomplish this, the rXg integrates with third party billing gateways through well understood and published APIs. The rXg sends messages to the configured gateways when billing events occur. The rXg then expects replies from the third party billing gateways in the format specified by their API. When properly configured, absolutely no operator intervention needs to occur to process payments and provision customers.

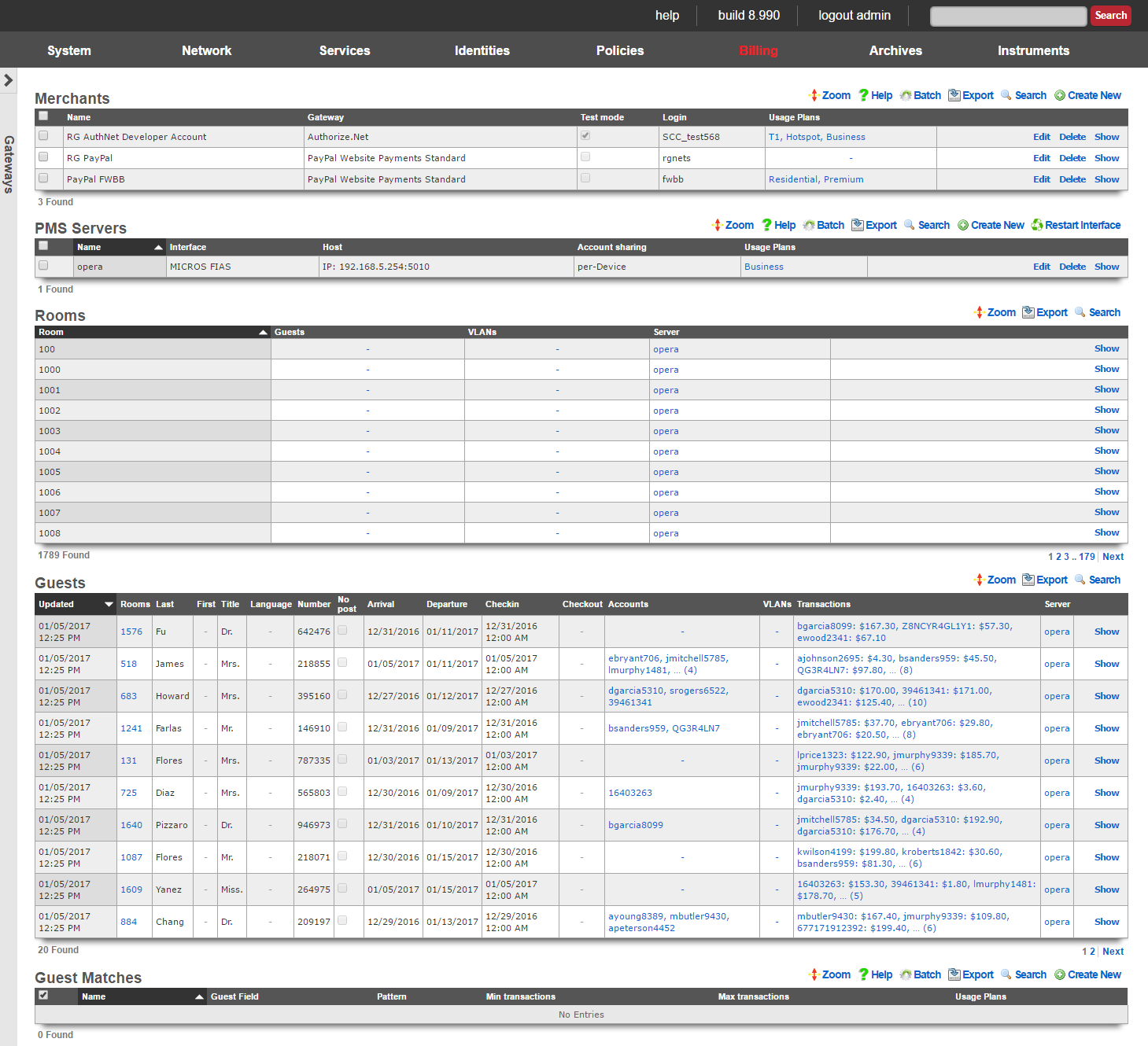

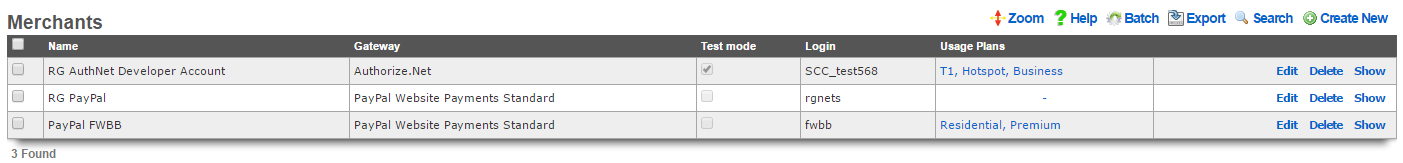

Merchants

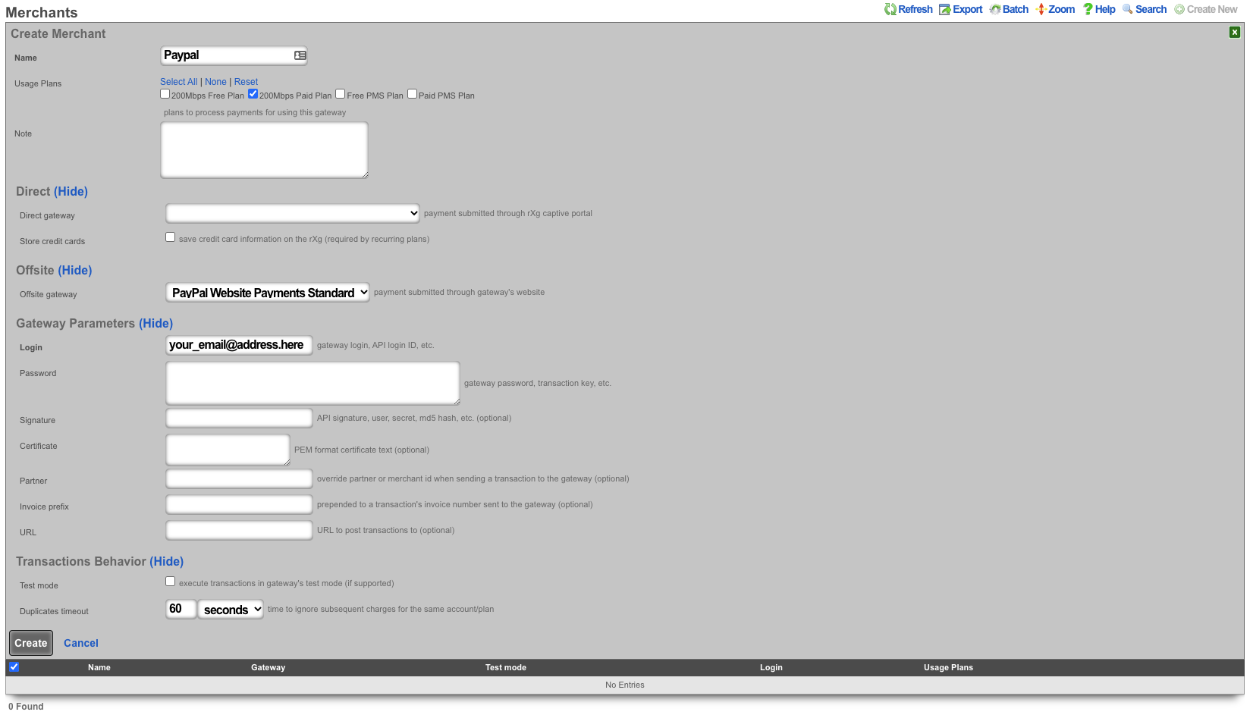

In order to accept payment via credit card, or other mechanism such as PayPal, you need to configure a merchant record that contains the information necessary to contact the external payment gateway. Each merchant record requires an account that must be setup with the external payment gateway before any charges may be posted. For example, having a valid PayPal account is a prerequisite to creating a working merchant record that posts to PayPal.

The name field is an arbitrary string descriptor used only for administrative identification. Choose a name that reflects the purpose of the record. This field has no bearing on the configuration or settings determined by this scaffold.

Some merchants support Test or sandbox mode. Checking this checkbox will alert the merchant that you are operating in a testing mode and will not charge the accounts used while testing is enabled. Refer to your merchant's documentation for more information, as some merchants (e.g., Paypal) require you to create special test accounts to use sandbox mode.

The Login, Password, Signature, and Partner fields will be provided by the merchant you are using. Not all merchants use all four pieces of information.

When performing a charge to direct merchant gateways (e.g., Authorize.Net), the id of the Merchant Transaction record stored on the rXg is passed along to the merchant as the invoice and order_id fields. The optional invoice prefix field is prepended to the invoice and order_id. For offsite merchant gateways (e.g., PayPal Website Payments Standard), the invoice and order_id fields are determined by the merchant.

You will also need to check the Usage Plans that you want to be purchasable through this merchant. Please note that this can also be done from the usage plan configuration section.

The note field is a place for the administrator to enter a comment. This field is purely informational and has no bearing on the configuration settings.

Direct Gateways

The rXg supports the following direct payment gateways.

| name | supported countries |

|---|---|

| 1stPayGateway.Net | US |

| Adyen | AT, AU, BE, BG, BR, CH, CY, CZ, DE, DK, EE, ES, FI, FR, GB, GI, GR, HK, HU, IE, IS, IT, LI, LT, LU, LV, MC, MT, MX, NL, NO, PL, PT, RO, SE, SG, SK, SI, US |

| Allied Wallet | US |

| Authorize.Net | AU, CA, US |

| Axcess MS | AD, AT, BE, BG, BR, CA, CH, CY, CZ, DE, DK, EE, ES, FI, FO, FR, GB, GI, GR, HR, HU, IE, IL, IM, IS, IT, LI, LT, LU, LV, MC, MT, MX, NL, NO, PL, PT, RO, RU, SE, SI, SK, TR, US, VA |

| Bambora Asia-Pacific | AU, NZ |

| Bank Frick | LI, US |

| Banwire | MX |

| Barclaycard Smartpay | AL, AD, AM, AT, AZ, BY, BE, BA, BG, HR, CY, CZ, DK, EE, FI, FR, DE, GR, HU, IS, IE, IT, KZ, LV, LI, LT, LU, MK, MT, MD, MC, ME, NL, NO, PL, PT, RO, RU, SM, RS, SK, SI, ES, SE, CH, TR, UA, GB, VA |

| Barclays ePDQ Extra Plus | GB |

| BBS Netaxept | NO, DK, SE, FI |

| Be2Bill | FR |

| Beanstream.com | CA, US |

| BluePay | US, CA |

| BlueSnap | US, CA, GB, AT, BE, BG, HR, CY, CZ, DK, EE, FI, FR, DE, GR, HU, IE, IT, LV, LT, LU, MT, NL, PL, PT, RO, SK, SI, ES, SE, AR, BO, BR, BZ, CL, CO, CR, DO, EC, GF, GP, GT, HN, HT, MF, MQ, MX, NI, PA, PE, PR, PY, SV, UY, VE |

| Bogus | |

| Borgun | IS, GB, HU, CZ, DE, DK, SE |

| BPoint | AU |

| Braintree | US, CA, AD, AT, BE, BG, HR, CY, CZ, DK, EE, FI, FR, GI, DE, GR, GG, HU, IS, IM, IE, IT, JE, LV, LI, LT, LU, MT, MC, NL, NO, PL, PT, RO, SM, SK, SI, ES, SE, CH, TR, GB, SG, HK, MY, AU, NZ |

| Braintree (Blue Platform) | US, CA, AD, AT, BE, BG, HR, CY, CZ, DK, EE, FI, FR, GI, DE, GR, GG, HU, IS, IM, IE, IT, JE, LV, LI, LT, LU, MT, MC, NL, NO, PL, PT, RO, SM, SK, SI, ES, SE, CH, TR, GB, SG, HK, MY, AU, NZ |

| Braintree (Orange Platform) | US |

| BridgePay | CA, US |

| CAMS: Central Account Management System | US |

| Card Connect | US |

| Cardknox | US, CA, GB |

| CardProcess VR-Pay | BE, BG, CZ, DK, DE, EE, IE, ES, FR, HR, IT, CY, LV, LT, LU, MT, HU, NL, AT, PL, PT, RO, SI, SK, FI, SE, GB, IS, LI, NO, CH, ME, MK, AL, RS, TR, BA |

| CardSave | GB |

| CardStream | GB, US, CH, SE, SG, NO, JP, IS, HK, NL, CZ, CA, AU |

| CC5 | |

| Cecabank | ES |

| CenPOS | AD, AI, AG, AR, AU, AT, BS, BB, BE, BZ, BM, BR, BN, BG, CA, HR, CY, CZ, DK, DM, EE, FI, FR, DE, GR, GD, GY, HK, HU, IS, IL, IT, JP, LV, LI, LT, LU, MY, MT, MX, MC, MS, NL, PA, PL, PT, KN, LC, MF, VC, SM, SG, SK, SI, ZA, ES, SR, SE, CH, TR, GB, US, UY |

| Checkout.com | AD, AT, BE, BG, CH, CY, CZ, DE, DK, EE, ES, FO, FI, FR, GB, GI, GL, GR, HR, HU, IE, IS, IL, IT, LI, LT, LU, LV, MC, MT, NL, NO, PL, PT, RO, SE, SI, SM, SK, SJ, TR, VA |

| Checkout.com Unified Payments | AD, AE, AR, AT, AU, BE, BG, BH, BR, CH, CL, CN, CO, CY, CZ, DE, DK, EE, EG, ES, FI, FR, GB, GR, HK, HR, HU, IE, IS, IT, JO, JP, KW, LI, LT, LU, LV, MC, MT, MX, MY, NL, NO, NZ, OM, PE, PL, PT, QA, RO, SA, SE, SG, SI, SK, SM, TR, US |

| Citrus Pay | AR, AU, BR, FR, DE, HK, MX, NZ, SG, GB, US |

| Clearhaus | DK, NO, SE, FI, DE, CH, NL, AD, AT, BE, BG, HR, CY, CZ, FO, GL, EE, FR, GR, HU, IS, IE, IT, LV, LI, LT, LU, MT, PL, PT, RO, SK, SI, ES, GB |

| CommerceGate | AD, AT, AX, BE, BG, CH, CY, CZ, DE, DK, ES, FI, FR, GB, GG, GI, GR, HR, HU, IE, IM, IS, IT, JE, LI, LT, LU, LV, MC, MT, NL, NO, PL, PT, RO, SE, SI, SK, VA |

| Conekta Gateway | MX |

| Creditcall | US |

| Credorax Gateway | AD, AT, BE, BG, HR, CY, CZ, DK, EE, FR, DE, GI, GR, GG, HU, IS, IE, IM, IT, JE, LV, LI, LT, LU, MT, MC, NO, PL, PT, RO, SM, SK, ES, SE, CH, GB |

| CT Payment | US, CA |

| Culqi | PE |

| CyberSource | US, AE, BR, CA, CN, DK, FI, FR, DE, IN, JP, MX, NO, SE, GB, SG, LB, PK |

| DataCash | GB |

| Decidir | AR |

| DIBS | US, FI, NO, SE, GB |

| Digitzs | US |

| dLocal | AR, BR, CL, CO, MX, PE, UY, TR |

| E-xact | CA, US |

| EBANX | BR, MX, CO, CL, AR, PE |

| Efsnet | US |

| Elavon MyVirtualMerchant | US, CA, PR, DE, IE, NO, PL, LU, BE, NL, MX |

| Element | US |

| ePay | DK, SE, NO |

| EVO Canada | CA |

| eWAY | AU |

| eWay Managed Payments | AU |

| eWAY Rapid 3.1 | AU, NZ, GB, SG, MY, HK |

| Ezic | AU, CA, CN, FR, DE, GI, IL, MT, MU, MX, NL, NZ, PA, PH, RU, SG, KR, ES, KN, GB, US |

| Fat Zebra | AU |

| Federated Canada | CA |

| Finansbank WebPOS | US, TR |

| FirstData Global Gateway e4 | CA, US |

| FirstData Global Gateway e4 v27 | CA, US |

| Flo2Cash | NZ |

| Flo2Cash Simple | |

| Forte | US |

| Garanti Sanal POS | US, TR |

| Global Transport | CA, PR, US |

| GlobalCollect | AD, AE, AG, AI, AL, AM, AO, AR, AS, AT, AU, AW, AX, AZ, BA, BB, BD, BE, BF, BG, BH, BI, BJ, BL, BM, BN, BO, BQ, BR, BS, BT, BW, BY, BZ, CA, CC, CD, CF, CH, CI, CK, CL, CM, CN, CO, CR, CU, CV, CW, CX, CY, CZ, DE, DJ, DK, DM, DO, DZ, EC, EE, EG, ER, ES, ET, FI, FJ, FK, FM, FO, FR, GA, GB, GD, GE, GF, GH, GI, GL, GM, GN, GP, GQ, GR, GS, GT, GU, GW, GY, HK, HN, HR, HT, HU, ID, IE, IL, IM, IN, IS, IT, JM, JO, JP, KE, KG, KH, KI, KM, KN, KR, KW, KY, KZ, LA, LB, LC, LI, LK, LR, LS, LT, LU, LV, MA, MC, MD, ME, MF, MG, MH, MK, MM, MN, MO, MP, MQ, MR, MS, MT, MU, MV, MW, MX, MY, MZ, NA, NC, NE, NG, NI, NL, NO, NP, NR, NU, NZ, OM, PA, PE, PF, PG, PH, PL, PN, PS, PT, PW, QA, RE, RO, RS, RU, RW, SA, SB, SC, SE, SG, SH, SI, SJ, SK, SL, SM, SN, SR, ST, SV, SZ, TC, TD, TG, TH, TJ, TL, TM, TN, TO, TR, TT, TV, TW, TZ, UA, UG, US, UY, UZ, VC, VE, VG, VI, VN, WF, WS, ZA, ZM, ZW |

| HDFC | IN |

| Heartland Payment Systems | US |

| iATS Payments | AU, BR, CA, CH, DE, DK, ES, FI, FR, GR, HK, IE, IT, NL, NO, PT, SE, SG, TR, GB, US, TH, ID, PH, BE |

| Inspire Commerce | US |

| InstaPay | US |

| IPP | AU |

| Iridium | GB, ES |

| iTransact | US |

| iVeri | US, ZA, GB |

| Ixopay | AO, AQ, AR, AS, AT, AU, AW, AX, AZ, BA, BB, BD, BE, BF, BG, BH, BI, BJ, BL, BM, BN, BO, BQ, BQ, BR, BS, BT, BV, BW, BY, BZ, CA, CC, CD, CF, CG, CH, CI, CK, CL, CM, CN, CO, CR, CU, CV, CW, CX, CY, CZ, DE, DJ, DK, DM, DO, DZ, EC, EE, EG, EH, ER, ES, ET, FI, FJ, FK, FM, FO, FR, GA, GB, GD, GE, GF, GG, GH, GI, GL, GM, GN, GP, GQ, GR, GS, GT, GU, GW, GY, HK, HM, HN, HR, HT, HU, ID, IE, IL, IM, IN, IO, IQ, IR, IS, IT, JE, JM, JO, JP, KE, KG, KH, KI, KM, KN, KP, KR, KW, KY, KZ, LA, LB, LC, LI, LK, LR, LS, LT, LU, LV, LY, MA, MC, MD, ME, MF, MG, MH, MK, ML, MM, MN, MO, MP, MQ, MR, MS, MT, MU, MV, MW, MX, MY, MZ, NA, NC, NE, NF, NG, NI, NL, NO, NP, NR, NU, NZ, OM, PA, PE, PF, PG, PH, PK, PL, PM, PN, PR, PS, PT, PW, PY, QA, RE, RO, RS, RU, RW, SA, SB, SC, SD, SE, SG, SH, SI, SJ, SK, SL, SM, SN, SO, SR, SS, ST, SV, SX, SY, SZ, TC, TD, TF, TG, TH, TJ, TK, TL, TM, TN, TO, TR, TT, TV, TW, TZ, UA, UG, UM, US, UY, UZ, VA, VC, VE, VG, VI, VN, VU, WF, WS, YE, YT, ZA, ZM, ZW |

| JetPay | US, CA |

| JetPay | US, CA |

| Komoju | JP |

| Kushki | CL, CO, EC, MX, PE |

| Latitude19 Gateway | US, CA |

| LinkPoint | US |

| MasterCard Internet Gateway Service (MiGS) | AU, AE, BD, BN, EG, HK, ID, JO, KW, LB, LK, MU, MV, MY, NZ, OM, PH, QA, SA, SG, TT, VN |

| maxiPago! | BR |

| Mercado Pago | AR, BR, CL, CO, MX, PE, UY |

| Merchant e-Solutions | US |

| Merchant One Gateway | US |

| Merchant Partners | US |

| Merchant Warrior | AU |

| MerchantWARE | US |

| Metrics Global | US |

| micropayment | DE |

| Modern Payments | US |

| Monei | AD, AT, BE, BG, CA, CH, CY, CZ, DE, DK, EE, ES, FI, FO, FR, GB, GI, GR, HU, IE, IL, IS, IT, LI, LT, LU, LV, MT, NL, NO, PL, PT, RO, SE, SI, SK, TR, US, VA |

| Moneris | CA |

| MoneyMovers | US |

| Mundipagg | US |

| NAB Transact | AU |

| NCR Secure Pay | US |

| NELiX TransaX | US |

| Netbanx by PaySafe | AF, AX, AL, DZ, AS, AD, AO, AI, AQ, AG, AR, AM, AW, AU, AT, AZ, BS, BH, BD, BB, BY, BE, BZ, BJ, BM, BT, BO, BQ, BA, BW, BV, BR, IO, BN, BG, BF, BI, KH, CM, CA, CV, KY, CF, TD, CL, CN, CX, CC, CO, KM, CG, CD, CK, CR, CI, HR, CU, CW, CY, CZ, DK, DJ, DM, DO, EC, EG, SV, GQ, ER, EE, ET, FK, FO, FJ, FI, FR, GF, PF, TF, GA, GM, GE, DE, GH, GI, GR, GL, GD, GP, GU, GT, GG, GN, GW, GY, HT, HM, HN, HK, HU, IS, IN, ID, IR, IQ, IE, IM, IL, IT, JM, JP, JE, JO, KZ, KE, KI, KP, KR, KW, KG, LA, LV, LB, LS, LR, LY, LI, LT, LU, MO, MK, MG, MW, MY, MV, ML, MT, MH, MQ, MR, MU, YT, MX, FM, MD, MC, MN, ME, MS, MA, MZ, MM, NA, NR, NP, NC, NZ, NI, NE, NG, NU, NF, MP, NO, OM, PK, PW, PS, PA, PG, PY, PE, PH, PN, PL, PT, PR, QA, RE, RO, RU, RW, BL, SH, KN, LC, MF, VC, WS, SM, ST, SA, SN, RS, SC, SL, SG, SX, SK, SI, SB, SO, ZA, GS, SS, ES, LK, PM, SD, SR, SJ, SZ, SE, CH, SY, TW, TJ, TZ, TH, NL, TL, TG, TK, TO, TT, TN, TR, TM, TC, TV, UG, UA, AE, GB, US, UM, UY, UZ, VU, VA, VE, VN, VG, VI, WF, EH, YE, ZM, ZW |

| NETbilling | US |

| NETPAY Gateway | MX |

| NetRegistry | AU |

| Network Merchants (NMI) | US |

| NMI | US |

| Ogone | BE, DE, FR, NL, AT, CH |

| Omise | TH, JP |

| Open Payment Platform | AD, AI, AG, AR, AU, AT, BS, BB, BE, BZ, BM, BR, BN, BG, CA, HR, CY, CZ, DK, DM, EE, FI, FR, DE, GR, GD, GY, HK, HU, IS, IN, IL, IT, JP, LV, LI, LT, LU, MY, MT, MX, MC, MS, NL, PA, PL, PT, KN, LC, MF, VC, SM, SG, SK, SI, ZA, ES, SR, SE, CH, TR, GB, US, UY |

| Openpay | CO, MX |

| Optimal Payments | CA, US, GB, AU, AT, BE, BG, HR, CY, CZ, DK, EE, FI, DE, GR, HU, IE, IT, LV, LT, LU, MT, NL, NO, PL, PT, RO, SK, SI, ES, SE, CH |

| Orbital Paymentech | US, CA |

| Pagar.me | BR |

| PagoFacil | MX |

| Pay Way | AU |

| Paybox Direct | FR |

| PayConex | US, CA |

| Payeezy | US, CA |

| Payex | DK, FI, NO, SE |

| PayGate PayXML | US, ZA |

| PayHub | US |

| PayJunction | US |

| PayJunction | US |

| Paymentez | MX, EC, CO, BR, CL, PE |

| PAYMILL | AD, AT, BE, BG, CH, CY, CZ, DE, DK, EE, ES, FI, FO, FR, GB, GI, GR, HR, HU, IE, IL, IM, IS, IT, LI, LT, LU, LV, MC, MT, NL, NO, PL, PT, RO, SE, SI, SK, TR, VA |

| PayPal Express Checkout | |

| PayPal Payflow Pro | US, CA, NZ, AU |

| PayPal Payments Pro (UK) | GB |

| PayPal Payments Pro (US) | CA, NZ, GB, US |

| PayPal Website Payments Pro (CA) | CA |

| Payscout | US |

| PaySecure | AU |

| Paystation | NZ |

| PayU India | IN |

| PayU Latam | AR, BR, CL, CO, MX, PA, PE |

| Pin Payments | AU |

| Plug'n Pay | US |

| ProPay | US, CA |

| Psigate | CA |

| PSL Payment Solutions | GB |

| Quantum Gateway | US |

| QuickBooks Merchant Services | US |

| QuickBooks Payments | US |

| Quickpay | |

| Qvalent | AU |

| Raven | US |

| Realex | IE, GB, FR, BE, NL, LU, IT, US, CA, ES |

| Redsys | ES |

| S5 | DK |

| SafeCharge | AT, BE, BG, CY, CZ, DE, DK, EE, GR, ES, FI, FR, GI, HK, HR, HU, IE, IS, IT, LI, LT, LU, LV, MT, MX, NL, NO, PL, PT, RO, SE, SG, SI, SK, GB, US |

| SagePay | GB, IE |

| Sallie Mae | US |

| SecureNet | US |

| SecurePay | US, CA, GB, AU |

| SecurePay (AU) | AU |

| SecurePayTech | NZ |

| SecurionPay | AD, BE, BG, CH, CY, CZ, DE, DK, EE, ES, FI, FO, FR, GI, GL, GR, GS, GT, HR, HU, IE, IS, IT, LI, LR, LT, LU, LV, MC, MT, MU, MV, MW, NL, NO, PL, RO, SE, SI |

| SkipJack | US, CA |

| SoEasyPay | US, CA, AT, BE, BG, HR, CY, CZ, DK, EE, FI, FR, DE, GR, HU, IE, IT, LV, LT, LU, MT, NL, PL, PT, RO, SK, SI, ES, SE, GB, IS, NO, CH |

| Spreedly | AD, AE, AT, AU, BD, BE, BG, BN, CA, CH, CY, CZ, DE, DK, EE, EG, ES, FI, FR, GB, GI, GR, HK, HU, ID, IE, IL, IM, IN, IS, IT, JO, KW, LB, LI, LK, LT, LU, LV, MC, MT, MU, MV, MX, MY, NL, NO, NZ, OM, PH, PL, PT, QA, RO, SA, SE, SG, SI, SK, SM, TR, TT, UM, US, VA, VN, ZA |

| Stripe (Legacy) | AT, AU, BE, BG, BR, CA, CH, CY, CZ, DE, DK, EE, ES, FI, FR, GB, GR, HK, IE, IT, JP, LT, LU, LV, MT, MX, NL, NO, NZ, PL, PT, RO, SE, SG, SI, SK, US |

| Stripe Payment Intents | AT, AU, BE, BG, BR, CA, CH, CY, CZ, DE, DK, EE, ES, FI, FR, GB, GR, HK, IE, IT, JP, LT, LU, LV, MT, MX, NL, NO, NZ, PL, PT, RO, SE, SG, SI, SK, US |

| Swipe Checkout | NZ, CA |

| Telr | AE, IN, SA |

| TNS | AR, AU, BR, FR, DE, HK, MX, NZ, SG, GB, US |

| Transact Pro | US |

| TransFirst | US |

| TransFirst Transaction Express | US |

| Transnational | US |

| Trexle | AD, AE, AT, AU, BD, BE, BG, BN, CA, CH, CY, CZ, DE, DK, EE, EG, ES, FI, FR, GB, GI, GR, HK, HU, ID, IE, IL, IM, IN, IS, IT, JO, KW, LB, LI, LK, LT, LU, LV, MC, MT, MU, MV, MX, MY, NL, NO, NZ, OM, PH, PL, PT, QA, RO, SA, SE, SG, SI, SK, SM, TR, TT, UM, US, VA, VN, ZA |

| TrustCommerce | US |

| USA ePay | US |

| USA ePay Advanced SOAP Interface | US |

| UsaEpay | |

| Vanco Payment Solutions | US |

| Verifi | US |

| ViaKLIX | US |

| VisaNet Peru Gateway | US, PE |

| WebPay | JP |

| WePay | US, CA |

| Windcave (formerly PaymentExpress) | AU, FJ, GB, HK, IE, MY, NZ, PG, SG, US |

| Wirecard | AD, CY, GI, IM, MT, RO, CH, AT, DK, GR, IT, MC, SM, TR, BE, EE, HU, LV, NL, SK, GB, BG, FI, IS, LI, NO, SI, VA, FR, IL, LT, PL, ES, CZ, DE, IE, LU, PT, SE |

| WorldNet | IE, GB, US |

| Worldpay Global | HK, GB, AU, AD, AR, BE, BR, CA, CH, CN, CO, CR, CY, CZ, DE, DK, ES, FI, FR, GI, GR, HU, IE, IN, IT, JP, LI, LU, MC, MT, MY, MX, NL, NO, NZ, PA, PE, PL, PT, SE, SG, SI, SM, TR, UM, VA |

| Worldpay Online Payments | HK, US, GB, BE, CH, CZ, DE, DK, ES, FI, FR, GR, HU, IE, IT, LU, MT, NL, NO, PL, PT, SE, SG, TR |

| Worldpay US | US |

Offsite Gateways

The rXg supports the following offsite payment gateways.

Example Configuration for Gateways

- Card Connect (Direct Gateway)

- Authorize.net (Direct Gateway)

- PayPal (Offsite Gateway)

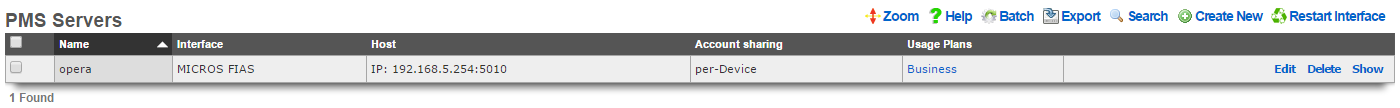

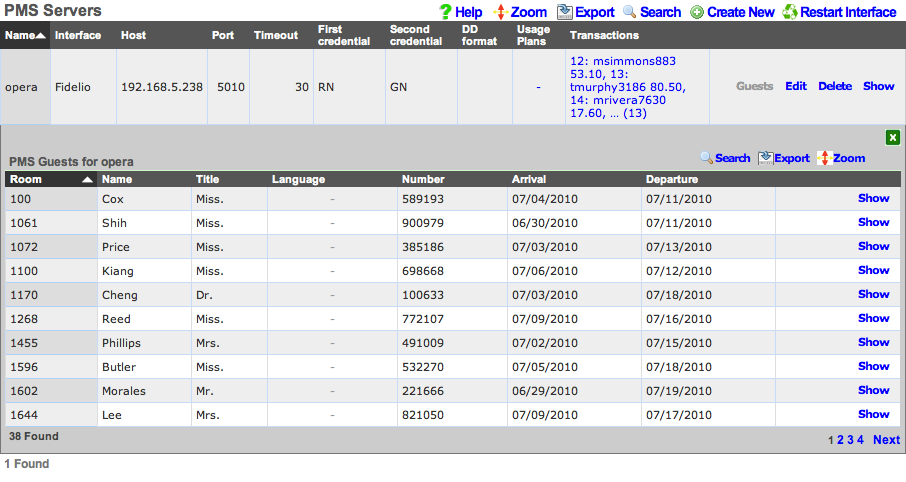

PMS Servers

The PMS servers scaffold configures the rXg property management system interface mechanism. The rXg property management system interface operates in a manner that is nearly identical to that of credit card processing gateways. However, rather than sending credit card information to the third-party server for processing, the PMS interface sends credentials such as a room number and guest name or number for charge posting. Successful charge posts result in a credit being applied to the Account journal.

Once a PMS server record is created, the rXg will immediately begin communication with the PMS and synchronize the guest database. Thus it is absolutely necessary that the PMS be setup and ready to receive interface communication from the rXg before a PMS server record is created.

Use the Guests action link on the right side of each PMS server record to view list of all guests that the rXg believes to be currently checked in and valid for charge posting. The Guests sub scaffold is particularly useful when a hospitality guest reports that they cannot login with their credentials. Searching the Guests sub scaffold is the easiest way to find what credentials the rXg is expecting for a given guest.

The name field is an arbitrary string descriptor used only for administrative identification. Choose a name that reflects the purpose of the record. This field has no bearing on the configuration or settings determined by this scaffold.

The interface field configures the API that the rXg will use to communicate with the property management system. The property management system must be configured accept communication using the same protocol that is specified here.

The usage plans field enables the operator to choose plans that are allowed to be billed to the property management system. Usage plans may only be associated with one external billing gateway such as a merchant or a property management system. Thus any usage plan that is being directly billed to a credit card may not be used in conjunction with a pms server record.

The account sharing field configures how accounts are shared between multiple registered guests in a room's folio. per-Device: an Account is created for every device (old behavior). per-Guest: an Account is created for each unique guest name checked into a room and shared by all devices that supplied the same name and room. per-Room: an Account is created for each set of guest names checked into a room at the same time and shared between all devices.

The host field must contain the IP address or domain name of the property management system interface server. It is assumed that the property management system interface server will use TCP/IP for third-party integration.

The port field must contain the port on which the property management system is listening for connections. The rXg will initiate the connection from a random high port. It is expected that traffic originating from any port on the rXg be allowed to access the property management server on this port.

The timeout field specifies the number of seconds that the rXg will wait for a response from the property management system. If the property management system fails to respond by the configured timeout , the transaction will be considered a failure by the rXg.

The UDF Behaviors define patterns that will be used to determine deployment specific behavior for particular cases of updates to the PMS. For instance, in the Infor REST integration, this is used to define patterns that will be considered for detecting when the guest has been assigned a one time access (OTA) email from a travel platform like Expedient, Agoda or similar. This is only implemented for Infor REST currently.

The dialed digits (DD) field is used by the rXg to communicate the MAC address of the end-user device that executed the charge posting. This allows the operator to understand how many individual devices are being used by a hospitality guest to access the Internet. The DD format field configures how the end-user's MAC address is formatted before sending it to the property management system as the DD field. The rXg sends the MAC address in decimal format by default because the FIAS standard specifies that the DD field be numeric. However, in practice many operators find that sending the MAC in hex is the easiest way to ensure that the posts for hospitality guests is accurate.

The subsequent transaction fields configure the PMS gateway to change the amount billed for subsequent transactions that originate from the same PMS guest. This feature allows the operator to charge less (or charge nothing) for a specified number of additional devices beyond the primary registered device. A follow-on transaction will only be marked subsequent (and thus discounted), if it satisfies both the subsequent transaction max count restriction as well as the subsequent transaction lifetime restriction.

The subsequent transaction max count specifies the maximum number of transactions that will be considered subsequent after a primary (non-subsequent) transaction. Setting the subsequent transaction max count to 0 disables this feature entirely as no transactions will ever be considered subsequent.

The subsequent transaction lifetime (s) field specifies the maximum amount of time (in seconds) that may elapse between a primary (non-subsequent) transaction and a sub-sequent transaction. If the elapsed time between a primary (non-subsequent) transaction and a follow-on transaction exceeds the configured subsequent transaction lifetime (s), the transaction will not be marked as subsequent and will not be discounted.

The subsequent transaction price reduction specifies the reduction in amount to be charged for follow-on transactions marked as subsequent. The value may be specified as an absolute number (e.g., 12.95) or as a percentage (e.g., 75%). If an absolute number is specified, the specified value will be subtracted from the plan price. If the resulting amount is less than zero, a charge of 0.00 will be sent to the PMS. Similarly, if a percentage is specified, the final amount transmitted to the PMS is calculated by discounting the specified percentage of the original usage plan price.

For example, if an operator wishes to allow three devices per day to acquire Internet access based on a PMS charge posting, the appropriate settings are:

| subsequent transaction max count | 2 | | subsequent transaction lifetime | 86400 | | subsequent price reduction | 99999 |

Alternatively, if an operator wishes to allow up to 5 additional devices to acquire Internet at a significant (75%) discount within two days the first full price PMS posting, the appropriate settings are:

| subsequent transaction max count | 5 | | subsequent transaction lifetime | 172800 | | subsequent price reduction | 75% |

The note field is a place for the administrator to enter a comment. This field is purely informational and has no bearing on the configuration settings.

PMS Guest Matches

The PMS Guest Matches scaffold enables operators to control the availability of the Usage Plans that are associated with the PMS Server to certain PMS Guests. For example, this scaffold may be used to configure the rXg to offer free Internet to PMS Guests who are checked in with a rate code ofINTC, reduced price Internet to PMS Guests with a block code of ACORP and special high speed, high priority Internet access with an SLA for PMS Guests staying in suites (identified by room type STE).

The name field is an arbitrary string descriptor used only for administrative identification. Choose a name that reflects the purpose of the record. This field has no bearing on the configuration or settings determined by this scaffold.

The Guest Field specifies the PMS Guest field that is the location that will be considered for this PMS Guest Match rule. The operator may choose from almost any field present in the PMS Guest record. The most frequently used options for this are the custom0, custom1, ... custom9fields which correspond to the FIAS A0, A1, ...A9 fields. Typically, the Ax FIAS fields are mapped to:

Field Name A0Rate Code A1Group Code A2Block Code A3Room Type A4Membership Type A5Membership Number A6Source

The Pattern field specifies a string that must match the value of the field specified in the Guest Field parameter in order for this PMS Guest Match to be effective. For example, if the operator desires to have this match rule take effect when the rate code is INTC, the Guest Field would be set to custom0 and the Pattern would be set toINTC.

The Min transactions and Max transactions fields restrict this PMS Guest Match rule to only affect a PMS Guest that has completed a certain number of transactions. Only transactions that represent active (non-expired) Usage Plans purchased by the PMS guest are counted. For example, the PMS Guest Match mechanism will not count a transaction made by a PMS Guest that purchases a Usage Plan with two days of usage when the guest comes back to purchase another plan three days later.

One common use of the Min transactions and Max transactions fields is to configure the availability of "free Internet for the first device." To accomplish this the operator would create a PMS Guest Match rule with Min transactions set to 0 and Max transactions to set 1 linked to a Usage Plan that is free. Thus the PMS Guest has access to purchasing the "free plan" when there are no active Usage Plans associated with the account. The PMS Guest Match mechanism determines that there are no active Usage Plans because none have been purchased or because the ones that have been purchased have already expired.

These fields may also be used to configure the converse, for example, "buy one device, get free Internet for three additional devices." To accomplish this the operator would create a PMS Guest Match rule with Min transactions set to 1 and Max transactions set to 4. In this case access to the the "free plan" is only available to PMS Guests that have at least one active (non-expired) Usage Plan which the PMS Guest would have to pay for.

The checkboxes specified by the Usage Plans field are the Usage Plans that will be available to the user that is matched by this PMS Guest Match rule.

To create a "catch all" or "default" rule, create a PMS Guest Match rule with an empty Guest Field and Pattern. The Usage Plans selected by a PMS Guest Match rule configured as a "catch all" will be available to all PMS Guests that do not match any PMS Guest Match rules with an explicitly defined Guest Field and Pattern.

The note field is a place for the administrator to enter a comment. This field is purely informational and has no bearing on the configuration settings.

PMS Guest Match Examples

Example 1: Match "free" in custom 0 field and offer free plan.

In this example we will be looking at Custom field 0 containing a value of "free". If the field contains the word free the guest will have access to the same plan as other guests, but at zero cost. Guests that do not match will in this case pay $10.

When configuring the PMS server the following settings should be set to ensure the guest only sees the plans that match, and not the plan(s) that are available if they don't match anything. These settings are under the Plan Behavior section of the PMS server configuration. The main setting we are interested in here is the Show only matched plans checkbox. With this enabled the guest will only be displayed plans that they have matched against.

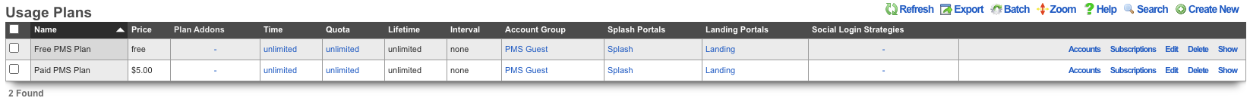

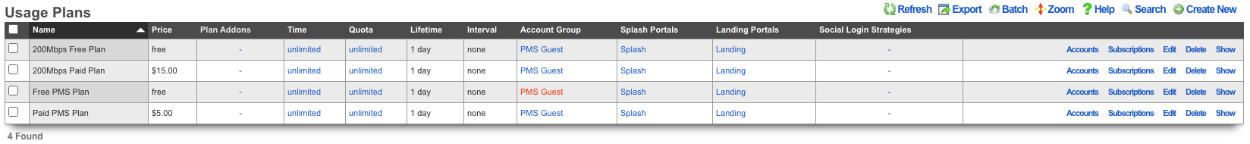

At a minimum we need to have two plans configured 1 that will be displayed to guests that match and the other free plan that will be displayed to guests that match our configured guest match. Below we can see that we have two plans configured 1 with a $5 price and the other with a price of free.

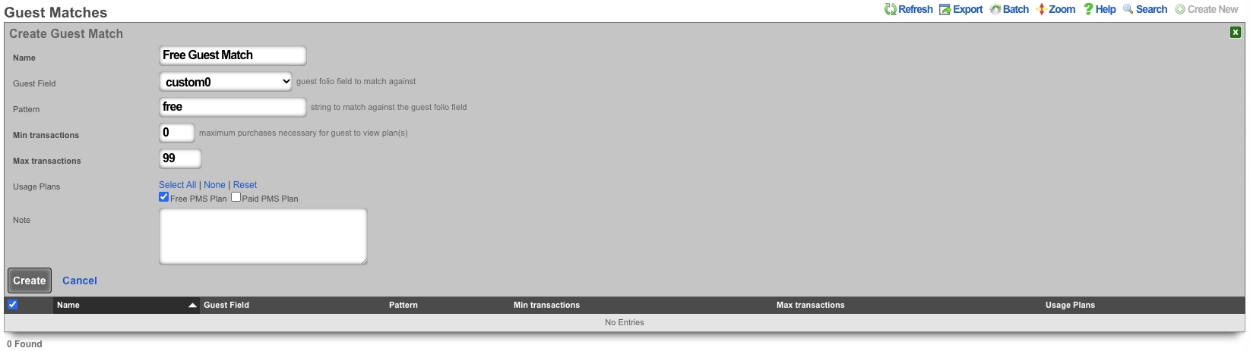

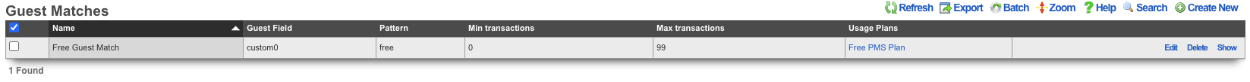

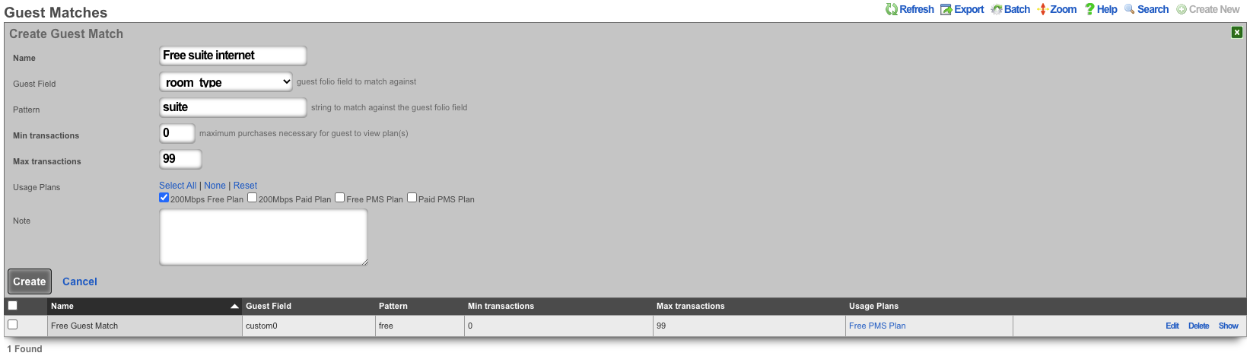

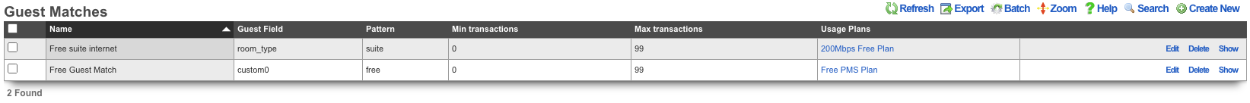

Next we will configure the Guest Match. Navigate to Billing::Gateways and create a new Guest Match. The Name field is arbitrary. The Guest Field for this example shoudl be set to custom0. The pattern we are looking for is the word free so we will enter that into the Pattern field. The Min transaction field is the minimum number of transactions the guest has before this plan will be displayed, in this case it should be set to 0 as we want the guest to be presented with this plan immediatly. The Max Transactions field can be used to no longer display a plan to a guest if they exceed the number of transactions, in this case we want the guest to always be presented with the free plan if they match. Lasty the Usage Plans field is used to pick which plans will be displayed to the guest if they match, for this example the Free PMS Plan will be selected. Then click the Create button.

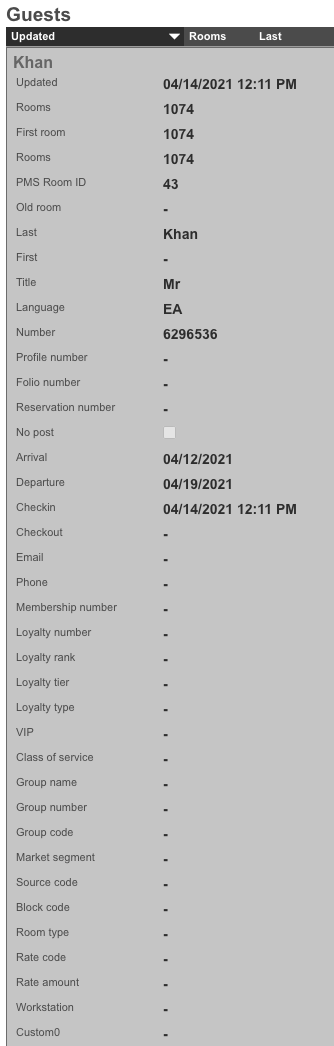

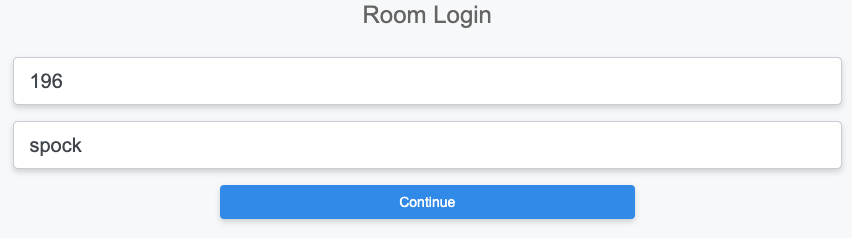

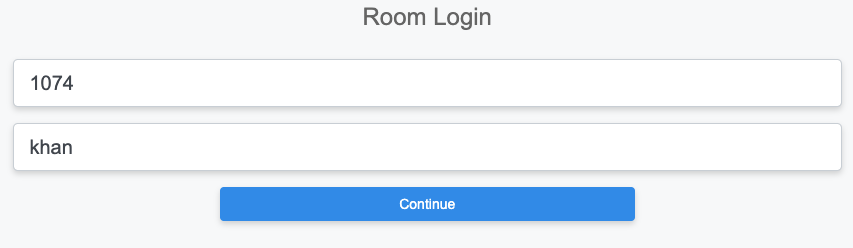

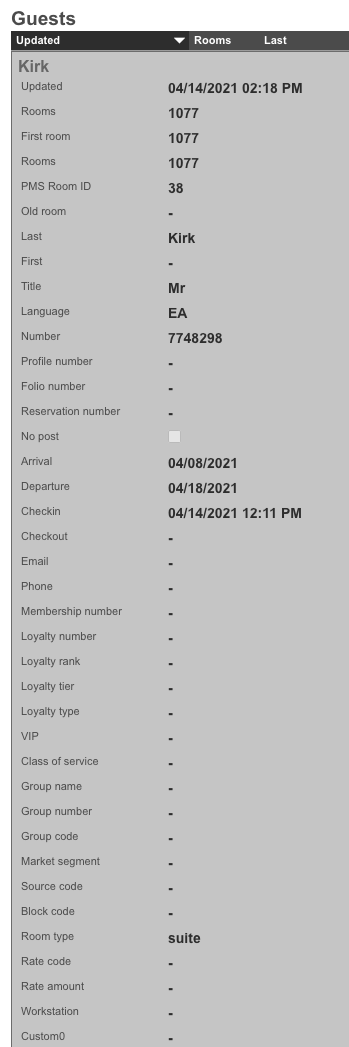

Now we will look at a guest that does not have the word free in the Custom0 field. Below is a screenshot showing that the guest Khan does not the word free in the Custom0 field.

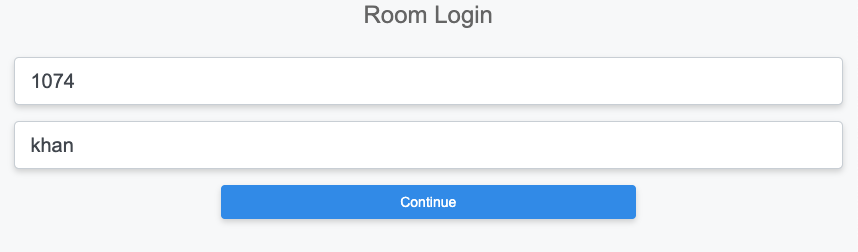

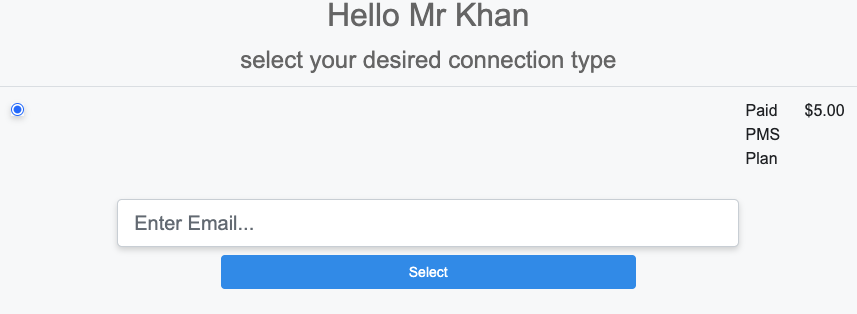

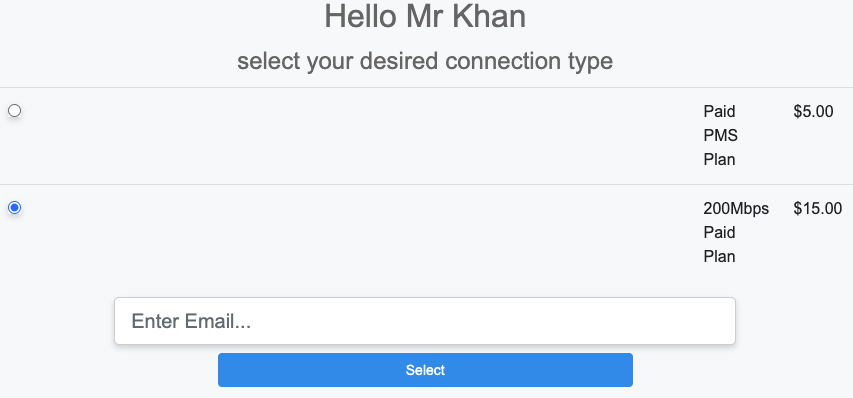

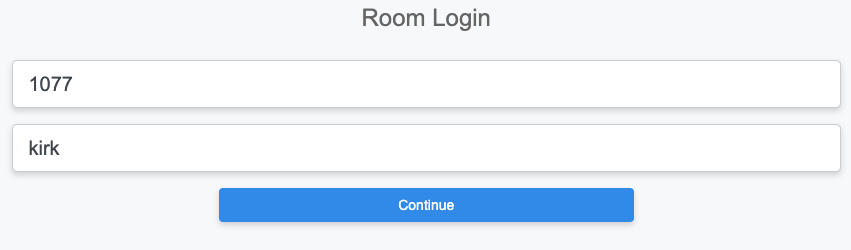

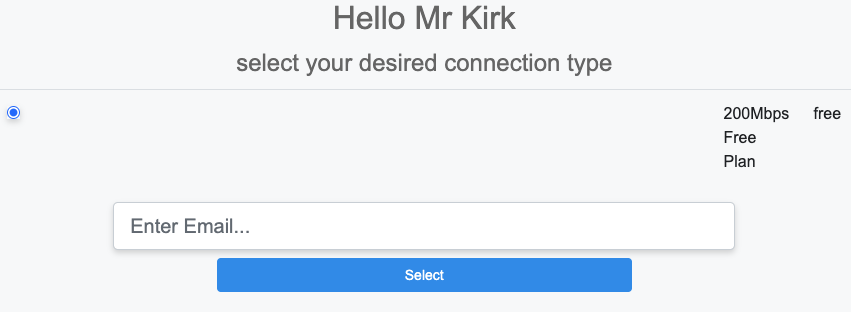

The screenshots below shows the guest entering their credentials and being presented with only the paid plan.

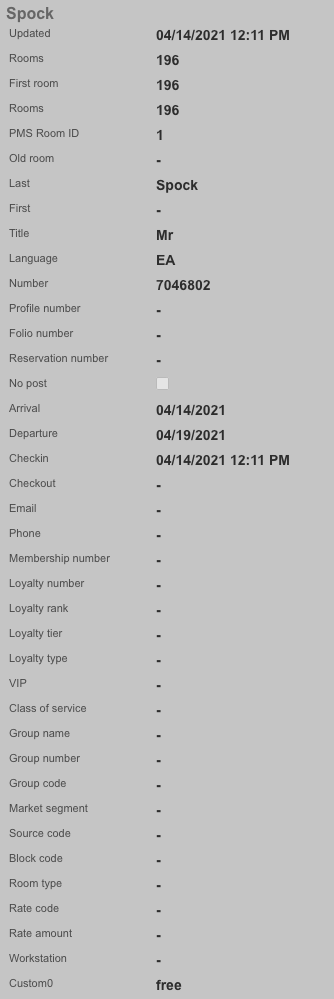

Next we will look at a guest that has the word free in the Custom0 field.

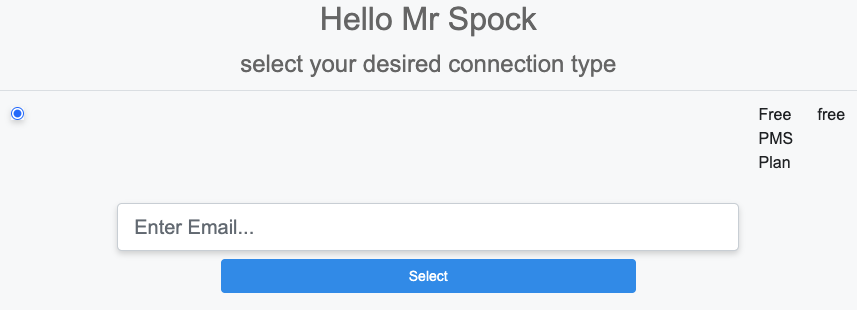

The screenshots below shows the guest entering their credentials and being presented with only the free plan.

Example 2: If room type is a suite offer free 200Mbps plan.

In this example we will configure a room type match against suite. We will leave the plans from above but also include a 200mbps plan that is paid and another that is free. We will also leave the free guest match we created before. This time when we log in with the guest room and name we will be offered the 200Mbps plan for free instead of the free plan.

Next we will create a new Guest Match that will match against the room_type field. The Name field is arbitrary. For Guest Match we will set the Guest Field to room_type , and the Pattern field to suite. Min and Max Transaction fields can be adjusted to change how many transactions the guest must have before it shows up, and determine after a number of transactions when the plan will no longer be offered. In this example we want it to be available to the guest all the time so Min Transactions will be set to 0, and Max Transactions will be set to 99 so that the guest would have to have over 99 transactions before the plan would no longer be presented. Lastly in the Usage Plans field we want to select the plans to be presented when the room type is suite, in this case we will select the 200Mbps Free Plan

Now we will look at a guest that does not have a room_type of "suite". We will use the guest Khan from the first example because we know they will not match.

Now we will find a guest that has "suite" in the room_type field.

The below screenshots show the guest with the room_type set to suite logging in and being presented with the 200Mbps free plan.

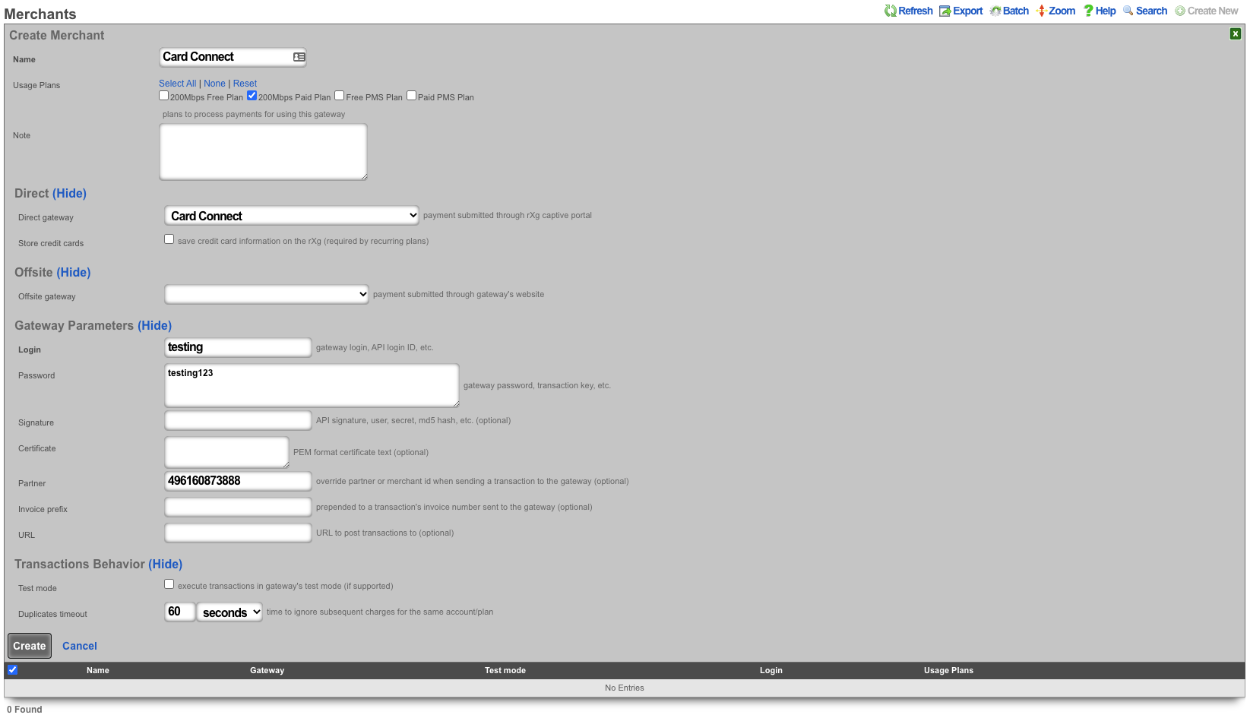

Card Connect Setup

When creating a Card Connect account there will be 3 pieces of information needed to setup the merchant in the rXg. Card Connect will provide an API Username & Password, along with a Merchant ID. For this example the API Username & Password will be testing:testing123, and the Merchant ID will be 496160873888.

Create a new Merchant. The Name field is arbitrary. Select the Usage plans that can use this merchant by selecting them in the Usage Plans field. Select Card Connect in the Direct Gateway field. The API Username testing will go into the Login field. The API Password testing123 will go into the Password field. Lastly the Merchant ID 496160873888 will go in the Partner field.

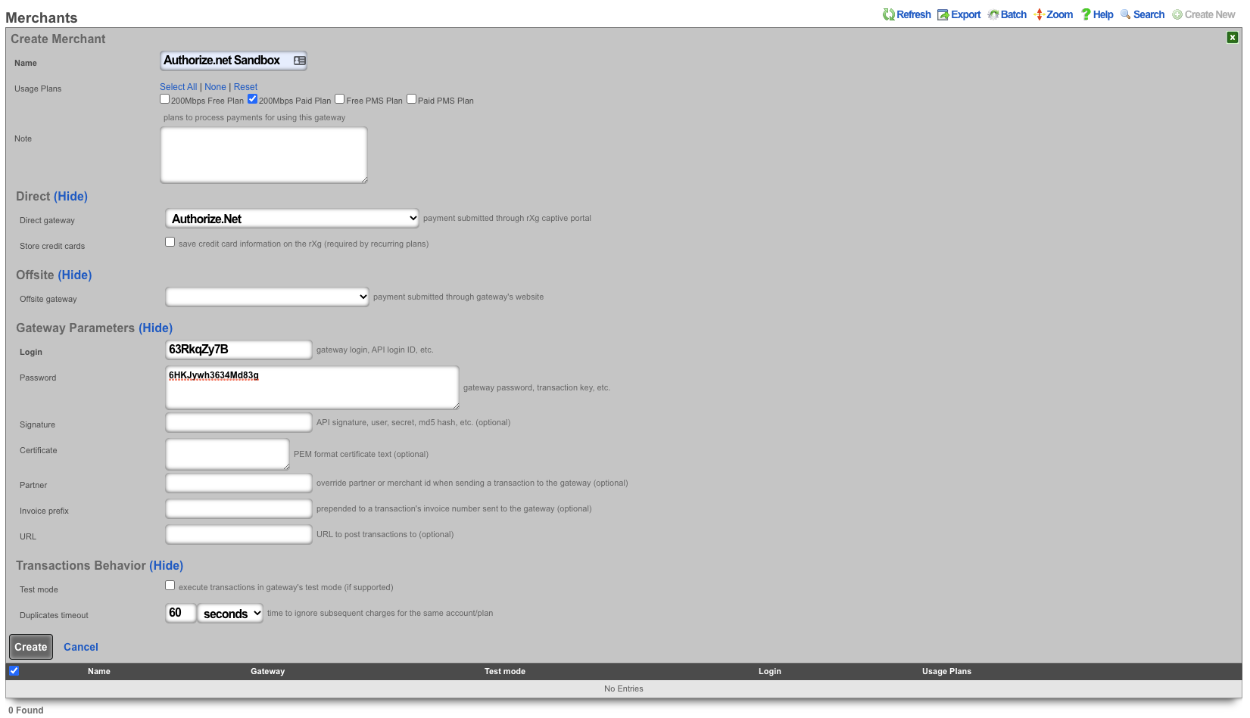

Authorize.net Setup

When creating an Authorize.net account there will be 2 pieces of information needed to setup the merchant in the rXg. Authorize.net will provide an API Login ID, and a Transaction Key. For example the API Login ID will be 63RkqZy7B, and the Transaction Key will be 6HKJywh3634Md83g.

Create a new Merchant. The Name field is arbitrary. Select the Usage plans that can use this merchant by selecting them in the Usage Plans field. Select Authorize.net in the Direct Gateway field. The API Login ID 63RkqZy7B will go into the Login field. The Transaction Key 6HKJywh3634Md83g will go in the Password field.

PayPal Setup

When creating a PayPal merchant you only need to enter in the email address associated to the PayPal account you want the transactions to be delivered to. The PayPal account must have IPN (Instant Payment Notifications) enabled. If IPN is not enabled the rXg will not receive notification that the payment was successful. PayPal must be whitelisted in the Splash Portal otherwise users will not be able to communicate with PayPal and will not be able to complete the transaction.

Create a new Merchant. The Name field is arbitrary. Select the Usage plans that can use this merchant by selecting them in the Usage Plans field. Select Paypal Website Payments Standard from the Offsite Gateway field. Put the email address associated to your Paypal account in the Login field.

InnKey PMS Server Setup

InnKey PMS provides a JSON-based REST API for room inquiries and charge posting. The rXg integrates with InnKey's Wi-Fi Interface API (v1.0.0) using JWT token-based authentication.

InnKey will provide four pieces of information for each property:

- URL - The host the API (e.g.,

https://api.innkeypms.com) - Username - x-partner

- Password - x-accesskey

- InnKey Security Key - InnKey: x-securitykey Hotel-level site identifier (unique per property)

PMS Properties

The name field is an arbitrary string descriptor used only for administrative identification. Choose a name that reflects the purpose of the record. This field has no bearing on the configuration or settings determined by this scaffold.

The note field is a place for the administrator to enter a comment. This field is purely informational and has no bearing on the configuration settings.

The code field is a place to put a string that correlates with this property and its rooms.